Insights

Are you using our tool to send invoices? Then we have some great news! Your customers can pay their invoices online thanks to our new Mollie integration (which includes iDeal, Paypal and more).

With every invoice you send, a payment link will automatically be added. This means your customers will be able to pay immediately using iDeal, Paypal or credit card. Paying will be easier ánd faster.

You can find the simple steps to add the payment link to your invoices below. Be aware that you will need a business bank account to do so!

I don’t have a Mollie account

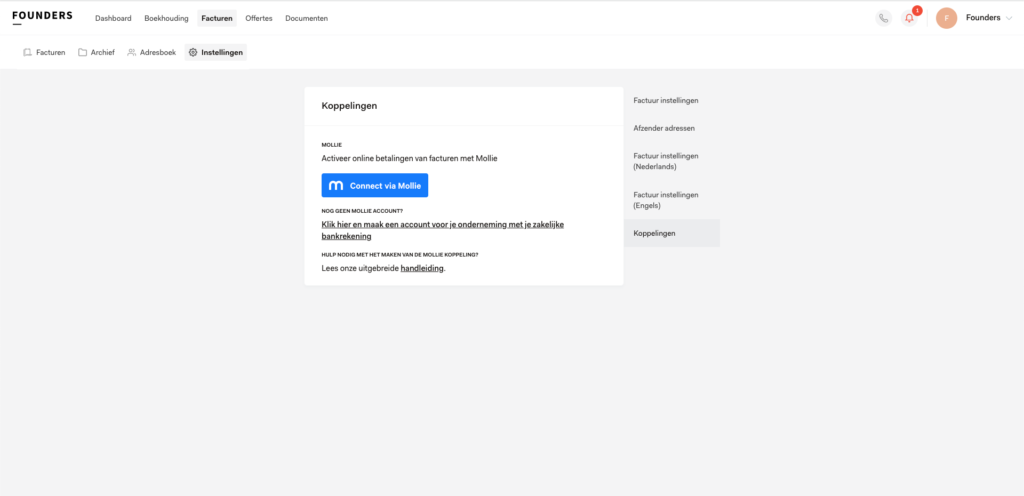

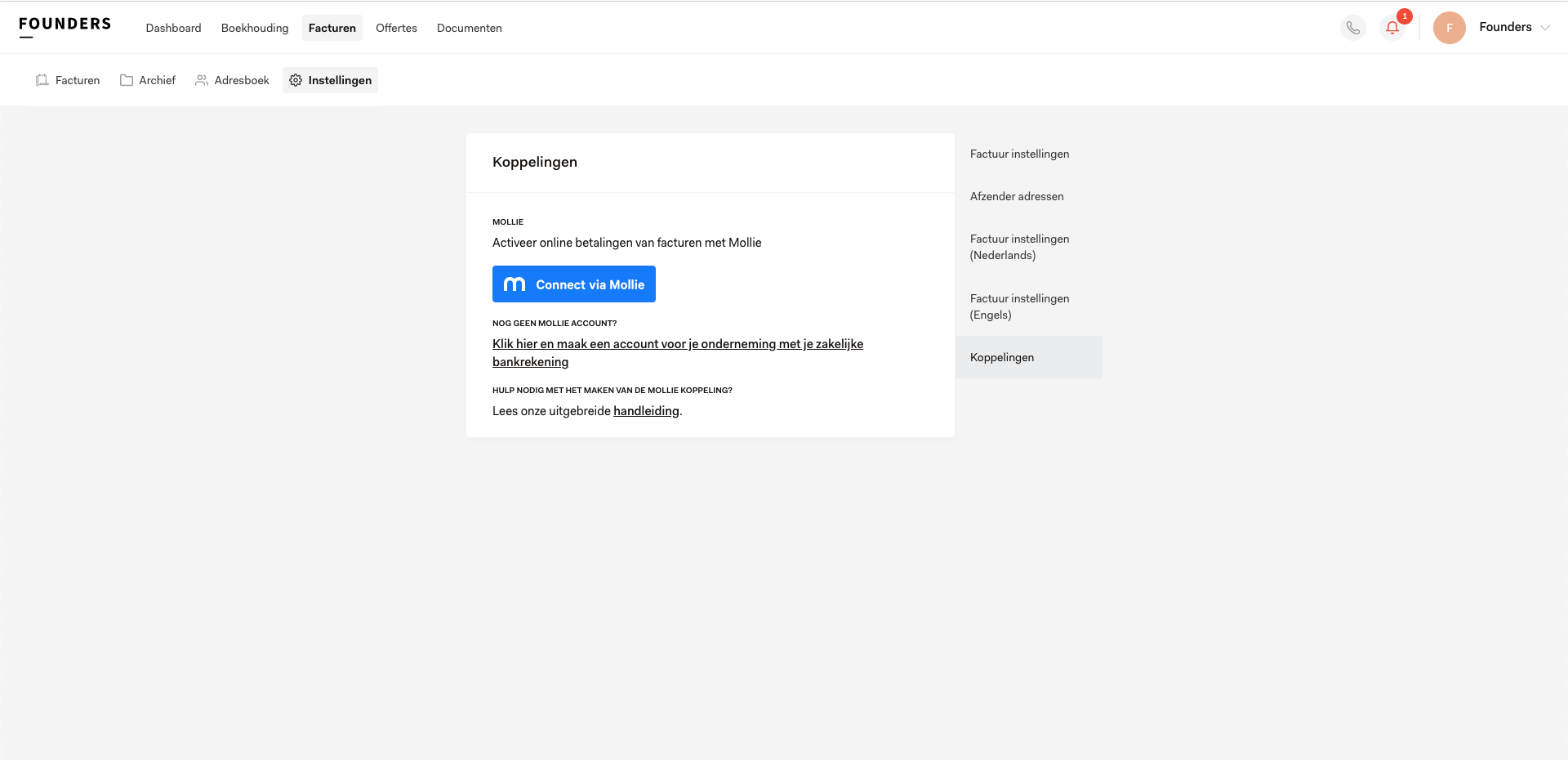

In the invoice settings for your business you can find the link to connect to Mollie. Click ‘Invoices’ in the main menu when you’re logged in to your account. In the submenu click ‘Settings’. On this page you will find several categories, one of which is ‘Integrations’. Here you’ll find the link to create a Mollie account.

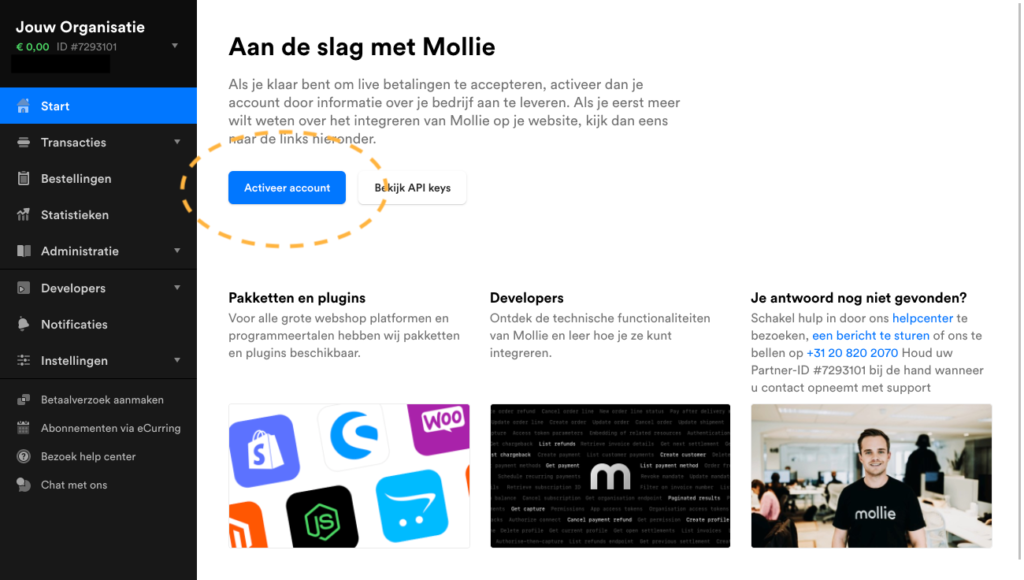

After you created a Mollie account, you need to fill in the necessary information. Mollie can only be connected to your account once you’ve provided your company details and you’ve chosen the paying methods you need. So, don’t forget to activate your account and complete these steps!

Once your account is completed ánd verified by Mollie you can make the connection with our tool. Go to ‘Integrations’ in Invoice settings and click ‘Connect via Mollie’. Give access to your account and that’s it! From now on a payment link will be added to your new invoices.

What are the costs for using Mollie?

The pricing for using Mollie can be found here: Pricing Mollie

How do I receive my money?

The payments to your own account are handled by Mollie. All information can be found here: Payments Mollie

What to register for ‘websiteprofiel’?

When creating a Mollie account you are required to fill in a website profile by filling in your website address. Fill in your own company’s website address with a clear description of your products and/or services. If you don’t have a website just fill in: ‘http://mijn.keesdeboekhouder.nl’ and the following description: ‘I send my invoices to customers using the Kees de Boekhouder tool. My customers receive their invoices by e-mail.’ This way Mollie will be able to verify your profile faster. In the comments you can add that you want to use Mollie for the payment of your invoices.

For more information or questions about your Mollie account, check out: Mollie

Linking an existing Mollie account

The Mollie link can be found through the invoice settings of your business. When you’re logged in to your account, click ‘Invoices’ in the main menu. In the submenu click ‘Settings’.

On this page you will find several categories, one of which is ‘Integrations’. This is where you can link with your existing Mollie account. Click ‘Connect via Mollie’. A pop up will appear to ask your permission to link to your Mollie data. After granting access you select your website profile and that’s it! From now on a payment link will be added to your new invoices.

I want to use another ‘website profile’, what do I register in the webaddress field?

When creating a Mollie account you are required to fill in a website profile by filling in your website address. Fill in your own company’s website address with a clear description of your products and/or services. If you don’t have a website just fill in: ‘http://mijn.keesdeboekhouder.nl’ and the following description: ‘I send my invoices to customers using the Kees de Boekhouder tool. My customers receive their invoices by e-mail.’ This way Mollie will be able to verify your profile faster. You can add in the comments that you want to use Mollie for the payment of your invoices by your customers.

For more information or questions about your Mollie account, check out: Mollie