Insights

UBO-register

Vanaf 27 september is het voor ondernemingen verplicht vast te leggen wie de eigenaren zijn van de onderneming en wie zeggenschap hebben. Dit moet vastgelegd worden in het UBO-register, UBO staat voor ‘ultimate beneficial owner’.

Wat is een UBO?

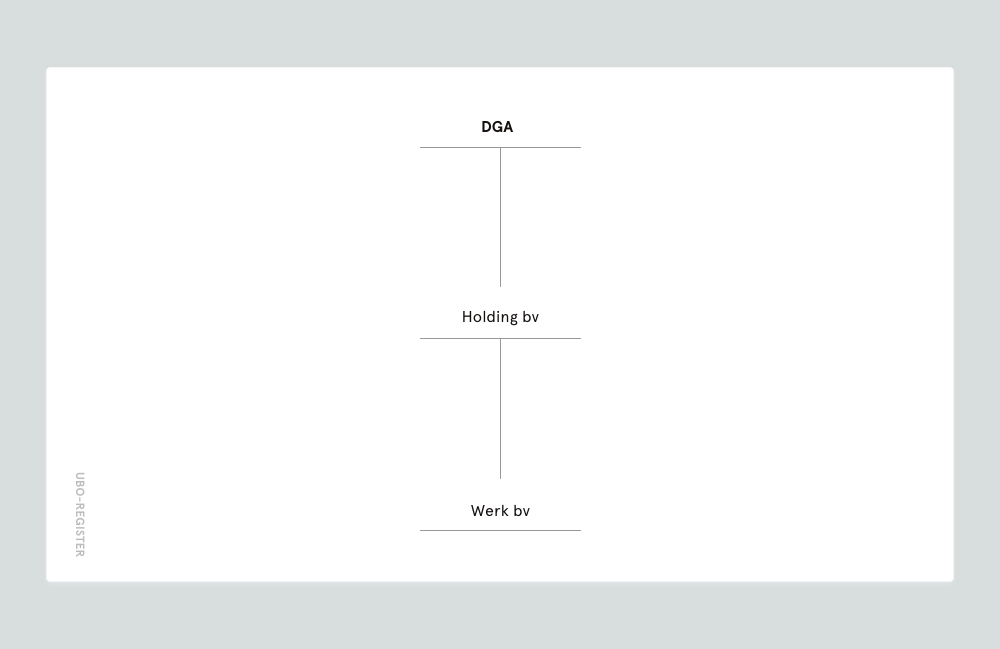

Een UBO is de persoon die de uiteindelijke eigenaar is of zeggenschap heeft in een organisatie. Het gaat dan om personen die meer dan 25% van de aandelen houden in een bv. Dit kan echter ook indirect via een andere bv. Dit is bijvoorbeeld in de volgende situatie het geval. De DGA is in dit geval ook UBO van Werk BV.

Vreemd aan de regelgeving van het UBO-register is dat je zelf moet bepalen wie de UBO’s binnen je organisatie zijn en dat de KvK hier niet in adviseert.

Waarom is er een UBO-register?

Het doel van het UBO-register is bijdragen aan het voorkomen van witwaspraktijken en terrorismefinanciering. De regeling is een voortvloeisel uit EU-regelgeving.

Door vast te leggen en openbaar te maken wie er zeggenschap hebben binnen een organisatie worden financiële transacties transparanter. Een web van bedrijven opzetten om daarmee financieel-economische criminaliteit te verhullen wordt daardoor lastiger. Dit draagt niet alleen bij aan het voorkomen van witwassen en terrorismefinanciering, maar ook corruptie, belastingontduiking en fraude zal eerder aan het licht komen.

Het register is dus nuttig voor de overheid. Maar ook voor de burger heeft het register toegevoegde waarde. Het zorgt ervoor dat je beter kunt zien met wie je uiteindelijk zakendoet.

Welke organisaties moeten zich inschrijven in het UBO-register?

Er is een lijst opgesteld met type organisaties die zich moeten inschrijven in het UBO-register en hun UBO’s moeten doorgeven bij de Kamer van Koophandel. Het gaat dan om:

- Niet-beursgenoteerde bv’s en nv’s

- Stichtingen

- Onderlinge waarborgmaatschappijen

- Coöperaties

- Rederijen

- Europese naamloze vennootschappen (SE)

- Europese coöperatieve vennootschappen (SCE)

- Europese economische samenwerkingsverbanden die hun zetel in Nederland hebben (EESV)

- Verenigingen:

- Met volledige rechtsbevoegdheid

- Met beperkte rechtsbevoegdheid maar met onderneming

- Personenvennootschappen:

- Maatschappen

- Vof’s

- Cv’s

Het inschrijven van de UBO van je organisatie doe je via de site van de Kamer van Koophandel.